Why The Most Trusted Crypto Analytics Platform Is Also The Biggest Scam Token Magnet—and What That Means for Your Wallet

Stop. Now reread that. The blockchain analytics titan you rely on to navigate the DeFi maze might be the very hub fueling the scam token wildfire you dread. The paradox is brutal: a platform boasting 1.5 million monthly users and $50 million annual revenue thrives by spotlighting tokens often tagged as predatory. How can a leader in transparency be entangled in opacity? The answer lies beneath the surface—a high-tech fortress of real-time data and blockchain indexing masking a murky trade-off between trust and profit. Today, we unravel the hidden calculus behind DEX Screener’s meteoric rise and its shadow economy, revealing what every trader hungry for genuine alpha must know to survive and thrive.

The Illusion of Transparency: When More Data Means More Noise

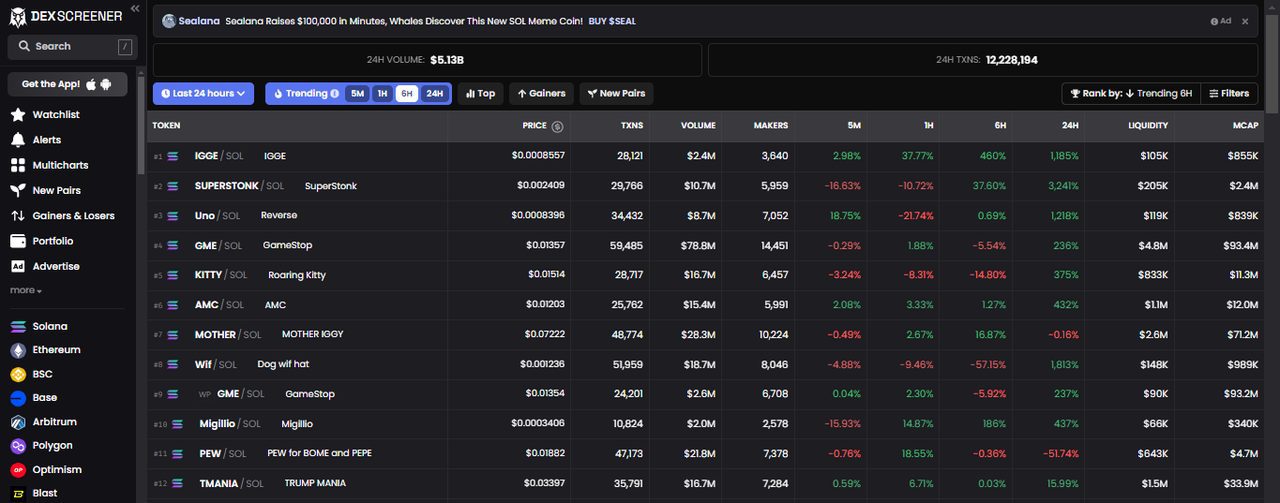

At first glance, DEX Screener appears as the quintessential solution for crypto traders seeking clarity. Tracking over 80 blockchains and 100 decentralized exchanges in real time, its proprietary blockchain indexer ingests raw logs every few seconds, offering unrivaled granularity. Yet this very abundance of data becomes a double-edged sword. The platform’s “freemium paradox” enables free access to core analytics, attracting millions, while monetizing through paid token listings and promotional boosts — some costing up to $100,000. This creates an ecosystem where visibility correlates directly with wallet depth rather than merit.

Herein lies the twist: the platform’s technical moat of direct on-chain data and TradingView integration paradoxically underpins a “dark pattern” environment. Scam tokens flood the listings, riding paid visibility to front pages and trending algorithms. Industry insiders reveal that DEX Screener’s $150,000 to $250,000 daily revenue from token advertising is deeply entwined with this phenomenon. The platform’s refusal to moderate aggressively—citing disclaimers and user responsibility—transforms its transparency into an unfiltered megaphone for both legitimate projects and predatory actors.

This paradox challenges the conventional wisdom that more data equates to better decision-making. Instead, traders face the cognitive overload of choice, where signal and noise blur. Without sophisticated filters or behavioral nudges, even seasoned investors risk falling prey to “anchoring bias” and “social proof” traps embedded in the platform’s design. The very architecture designed to empower users can inadvertently amplify FOMO and herd behavior, fueling the volatility and impermanent loss many seek to avoid.

Decoding the “Freemium Paradox”: How Monetization Shapes Market Dynamics

To understand DEX Screener’s rise, one must grasp its revenue engine. Unlike traditional crypto data providers, it eschews subscription-heavy models in favor of a tiered advertising approach. Token projects pay $300 for listings, with optional boosts and “Moonshot” launchpad campaigns offering revenue shares of up to 80%. This model creates a marketplace of attention where liquidity and volume metrics can be artificially inflated by promotional spend rather than organic demand.

This dynamic reshapes the DeFi landscape in subtle yet profound ways. Projects with deep pockets gain disproportionate attention; emerging tokens without marketing budgets languish in obscurity, regardless of utility or innovation. The platform’s proprietary trending algorithms, touted as objective indicators, become vectors for paid influence. This creates a feedback loop where visibility drives volume, volume drives price pumps, and pumps attract “whale” activity and speculative frenzy.

Yet DEX Screener’s business model is a tightrope walk. Critics, including Coinbase’s Head of Product Operations, have publicly decried the platform’s role in proliferating scam tokens. Yet no lawsuits or regulatory actions have materialized—likely due to the platform’s reliance on disclaimers and the decentralized nature of listings. This regulatory grey zone leaves traders exposed to “bounded rationality” limits and “loss aversion” pitfalls, often unaware their trusted analytics tool is a conduit for speculative risk amplification.

This raises a profound question for anyone looking to buy or sell crypto profitably: How do you parse genuine market signals from paid hype when your primary analytical lens is itself a commercial product? The answer lies in cultivating behavioral alpha—using cognitive heuristics and technological literacy to outsmart the system rather than blindly trusting it.

From Data Overload to Behavioral Alpha: The New Trader’s Edge

If the analytics battlefield is cluttered with noise and paid influence, survival hinges on mastering behavioral economics and on-chain analytics beyond raw data. For instance, DEX Screener offers whale tracking, portfolio watchlists without wallet connection, and custom alerts—tools ripe for strategic use but vulnerable to misinterpretation.

Consider the concept of “nudge design” integrated into trading bots and personalized alerts. Savvy traders combine DEX Screener’s real-time data with social sentiment analysis, early demand signals, and risk maps to anticipate trend reversals and avoid liquidation cascades. Recognizing “anchoring bias” in trending tokens or “regret minimization” in FOMO-driven buys allows traders to step back and act with clarity.

Further, integrating DEX Screener’s data with complementary platforms like Dune Analytics or Telegram trading bots creates a multi-layered defense against manipulation. The “utility curve” of token promotions can be read not as absolute truth but as probabilistic signals weighted by market psychology. This cognitive overlay transforms the platform from a passive observation post into an active decision engine.

Such behavioral coaching, combined with technical safeguards like slippage protection and cross-DEX arbitrage insights, empowers traders to navigate the paradoxical ecosystem where the most authoritative data source also harbors the greatest risks. This is not merely about avoiding scams but about recalibrating how we interpret “trust” and “transparency” in decentralized finance.

Reframing Trust: Why DEX Screener’s Paradox Could Catalyze a New Era of Crypto Literacy

At first blush, DEX Screener’s paradox seems a cautionary tale of tech-enabled risk and ethical ambiguity. Yet beneath the surface lies a systemic opportunity. By exposing the mechanics of token promotion and the psychological levers at play, the platform inadvertently educates its user base on the complex interplay of market forces and human behavior.

This creates what I call the “Transparency Paradox Effect”—where the flood of raw, unfiltered data forces traders to evolve beyond passive consumption into active interpretation and behavioral sophistication. The platform’s vast multichain coverage and real-time updates become a training ground for mastering cognitive biases, nudge design, and probabilistic reasoning.

As DeFi’s projected $616 billion market unfolds, the need for such literacy will only intensify. DEX Screener’s dominant position and massive user engagement position it not just as a data provider but as an unwitting catalyst for a new kind of trader empowerment—one that embraces complexity and ambiguity rather than seeking simplistic signals. In this light, its paradox is not a failure but an evolutionary accelerant for the crypto ecosystem.

For traders ready to move beyond FUD and hype, embracing this paradox unlocks deeper insights, better risk management, and ultimately, more sustainable profit strategies. The question isn’t whether DEX Screener is perfect—it’s whether you can harness its contradictions to gain an edge others miss.

How to Harness DEX Screener Without Falling Into the Trap

Practical steps for traders hungry to profit while sidestepping the pitfalls include: pairing DEX Screener data with independent social sentiment tools; setting automated alerts that emphasize volume quality over sheer quantity; employing whale tracking to detect genuine accumulation versus pump-and-dump schemes; and using portfolio stress tests to anticipate impermanent loss before committing capital.

Moreover, leveraging “dynamic pool fees” and “gas-fee optimization” strategies can mitigate costs in volatile markets, while reframing “loss aversion” and “regret minimization” through behavioral KPIs helps maintain discipline. Connecting DEX Screener’s API with Telegram bots or custom webhooks creates a frictionless UX that nudges users away from impulsive trades and toward deliberate strategy.

In this way, DEX Screener becomes less a data vendor and more a behavioral coaching platform—if you know how to decode the paradox. For newcomers and veterans alike, this mindset shift is the gateway to turning a potential minefield into a map of opportunity.

For those ready to explore how DEX Screener’s powerful features can be tailored for smarter trading, you can go here to download the latest tools and start your journey with enhanced personalization and automated alerts today.

Questions That Change Everything

Is DEX Screener promoting scam tokens intentionally?

Not intentionally, but its revenue model incentivizes paid listings without robust moderation, creating an environment where scam tokens gain visibility. The platform relies on disclaimers and user discretion, shifting responsibility but also exposing traders to higher risk. Recognizing this dynamic is crucial to avoid blind trust.

How can I differentiate genuine market trends from paid hype on DEX Screener?

Look beyond raw volume and trending scores. Combine whale tracking, social sentiment, and early demand signals. Use behavioral alpha techniques like nudge design and risk budgeting. Cross-reference with independent analytics platforms to validate signals before trading decisions.

Will regulatory scrutiny force DEX Screener to change its business model?

Possibly. The platform operates in a regulatory grey zone, and increasing attention on DeFi fraud may prompt tighter controls. However, DEX Screener’s decentralized data sourcing and disclaimers provide some buffer. Traders must prepare for evolving compliance landscapes and adapt their strategies accordingly.