Why DEX Screener’s Scam Token Paradise Reveals the Future of Trust in Crypto Analytics

Stop and reread this: The platform claiming to empower decentralized trading might be quietly fueling the very scams it promises to expose. Imagine a tool so indispensable to crypto traders that its flaws become the industry’s fault lines. This is not a bug but a feature of today’s DeFi analytics ecosystem. What if the rise of platforms like DEX Screener—boasting millions of users and soaring revenues—is actually a paradoxical driver of both transparency and chaos? The solution lies in decoding how technological excellence coexists with reputational risks, unveiling a new paradigm of trust and user empowerment in the wild west of crypto markets.

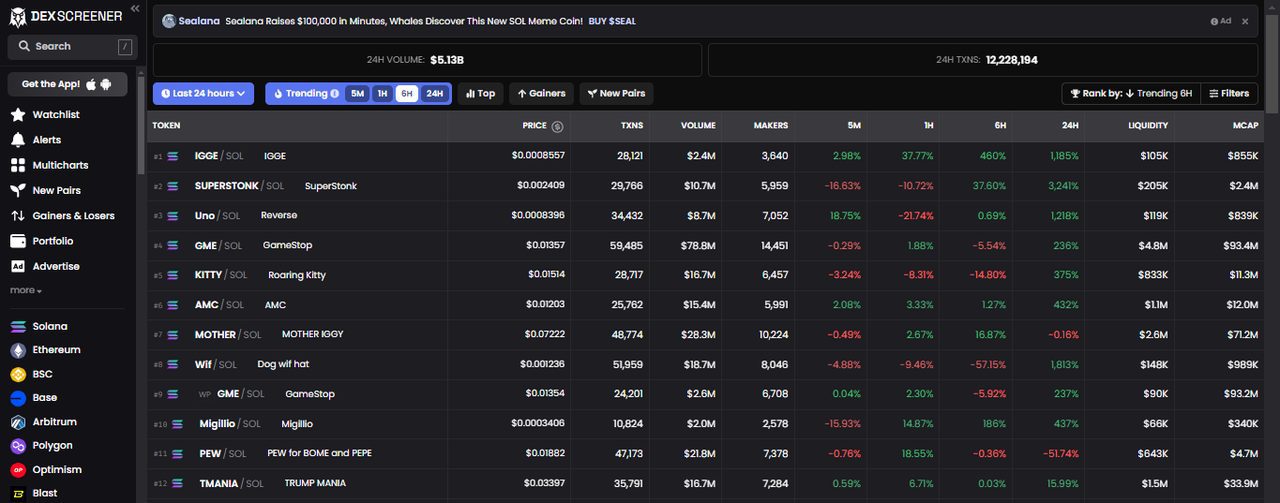

The Dark Mirror: When Transparency Feeds the Scam Economy

At first glance, DEX Screener appears as the archetype of a decentralized finance (DeFi) success story—boasting over 1.5 million monthly users, real-time analytics across 80+ blockchains, and a sleek TradingView integration. But beneath this impressive facade lies a paradox: the platform’s lucrative token listing and advertising model, generating upwards of $150,000 daily, has made it a magnet for scam tokens. Industry commentators and insiders, including Coinbase’s Head of Product Operations, have publicly condemned DEX Screener for “dark patterns” that prioritize paid promotions over genuine transparency. This creates a toxic feedback loop where the platform designed to expose risks inadvertently amplifies them.

This paradox challenges the conventional wisdom that more data and openness inherently increase market integrity. Instead, it reveals a systemic vulnerability: when an analytics platform’s revenue depends heavily on token advertising, it becomes incentivized to blur the line between legitimate projects and predatory actors. The result? Users face cognitive overload, battling FOMO and anchoring biases amid a flood of manipulated trending scores and boosted tokens. This forces a rethink of how trust is architected in decentralized ecosystems.

From Black Box to Glass House: The Tech Moat Hiding the Human Blindspots

DEX Screener’s technological prowess is undeniable. Its proprietary blockchain indexer processes raw logs across 80+ Layer-1 and Layer-2 networks without external APIs, delivering real-time updates every few seconds. This microservices architecture scales effortlessly with a remote team of fewer than 10 employees—a staggering revenue-to-employee ratio exceeding $25 million per head. Yet, this technical moat paradoxically exposes a human blindspot: reputation management.

Behind the scenes, the platform’s reliance on automated listing approvals with minimal manual moderation enables fraudulent tokens to surface prominently, eroding user trust. The paradox deepens when one considers the platform’s “freemium paradox”: free core services attract millions, but premium advertising and boost packages fuel the company’s growth and create conflicts of interest. Users who seek impartial analytics must now navigate an ecosystem where financial incentives encourage the elevation of risky assets—turning analytics into a marketplace of influence rather than pure information.

This dynamic reflects a broader behavioral economics phenomenon—“trust asymmetry”—where the cost of misplaced trust far outweighs the benefits of easy access. It also spotlights how reputation, often considered a soft asset, is as critical as technology in crypto infrastructure.

Behavioral Alpha and the New Frontier of Trader Onboarding

What if the solution to this trust paradox lies not in more data, but in smarter behavioral design? DEX Screener’s existing features—customizable alerts, whale tracking, portfolio monitoring without wallet connection—offer a fertile base for embedding behavioral nudges that counteract common cognitive biases like loss aversion and overtrading. Imagine automated FOMO dampeners triggered by social sentiment dips, or real-time slippage protection alerts aligned with volatility heatmaps.

Integrating these behavioral “guardrails” could transform the platform from a pure data aggregator into a “behavioral alpha” generator—helping traders avoid impulsive decisions driven by herd mentality or anchoring bias. The next evolution may come from syncing on-chain analytics with advanced nudge design, deploying Telegram trading bots that coach users through market stress with clarity framing and regret minimization strategies. Such innovation would not only increase user retention but also elevate the platform’s role as a trusted guide in a chaotic market.

For traders hungry to go beyond raw numbers, personalizing the DexScreener experience via webhooks and dynamic pool fee alerts could offer a bespoke toolkit to hedge impermanent loss or detect early demand signals across DEXs—empowering users with a cognitive toolkit as much as a technical one.

Cross-Chain Arbitrage and the Attention Economy: The Hidden Engine of DEX Screener’s Growth

DEX Screener’s extensive coverage—100+ DEXs across more than 80 blockchains—positions it uniquely in the exploding DeFi landscape. This breadth supports sophisticated strategies like cross-DEX arbitrage and MEV analysis, critical for professional traders. But the platform’s growth is not just technical; it’s deeply rooted in the crypto attention economy.

By enabling high-frequency data access and leveraging social proof via trending tokens and boosted listings, DEX Screener taps into trader psychology’s primal drives: status-seeking, herd behavior, and the urgency effect. This attention economy, paradoxically, both fuels the platform’s financial success and sows the seeds of reputational risk. Traders chasing “hot” tokens propelled by paid boosts may find themselves caught in liquidation cascades or impermanent loss traps.

Understanding this dynamic reframes the platform not merely as a neutral analytics provider, but as a behavioral marketplace where information asymmetry and incentive design collide. This insight invites traders to approach the platform with calibrated skepticism and strategic use of features like portfolio stress tests and risk maps.

Reimagining Trust: Towards a Hybrid Model of Transparency and Behavioral Governance

DEX Screener’s saga exposes a fundamental tension in DeFi analytics between decentralized transparency and centralized monetization incentives. The path forward likely involves hybrid governance models—combining automated blockchain indexing with community-driven reputational staking and regulatory filtering mechanisms that weed out scam tokens without stifling innovation.

Such models could integrate behavioral KPIs, leveraging user feedback loops and nudge design to balance commercial pressures with user protection. Incorporating dynamic pool fees and circuit breakers aligned with volatility surface data can further insulate traders from systemic shocks. The goal is a platform that is as much a behavioral coach as a data provider—a trusted ecosystem partner rather than a mere information conduit.

For those eager to explore this next frontier, the starting point is embracing tools that offer not just raw data but cognitive clarity. You can go here to experience how DexScreener’s evolving features empower traders to navigate this complex landscape with confidence.

Questions That Change Everything

Is DEX Screener knowingly enabling scams by monetizing token listings?

The platform operates in a regulatory gray zone where monetization incentives clash with user protection. While there is no public evidence of intentional scam promotion, the structural reliance on paid listings creates conflicts that indirectly facilitate scam token prominence. This is a systemic issue in crypto analytics rather than a simple case of bad actors.

Can behavioral design realistically reduce trader losses on platforms like DEX Screener?

Yes. Embedding nudges that counteract biases such as FOMO, anchoring, and loss aversion can materially improve decision-making. Behavioral alpha—gained from integrating psychology with analytics—offers a potent lever to enhance trader outcomes, especially in volatile, information-rich environments.

Should traders trust free analytics platforms given their revenue models?

Trust must be calibrated. Free access platforms often monetize via advertising, introducing potential biases. Savvy traders will use these tools as part of a broader toolkit, cross-referencing data sources, employing risk maps, and leveraging automated alerts to mitigate informational asymmetry and reputational risks.