The DexScreener Paradox: How Scam Tokens Fuel the Rise of Real-Time DeFi Intelligence

What if the very chaos that threatens decentralized finance is the secret engine powering its most powerful analytical platform? DexScreener, often condemned for promoting scam tokens, paradoxically stands as the beacon for millions seeking clarity in a wild market. The contradiction is glaring: can a platform accused of enabling deception actually be the greatest tool for genuine trader empowerment? Beneath the surface of controversy lies a hidden systemic truth about trust, automation, and behavioral economics reshaping crypto trading. This article peels back the layers of DexScreener’s growth, revealing how its controversial business model and cutting-edge tech infrastructure forge a new paradigm for navigating DeFi’s complexity.

When Scam Tokens Become the Market’s Unofficial Currency

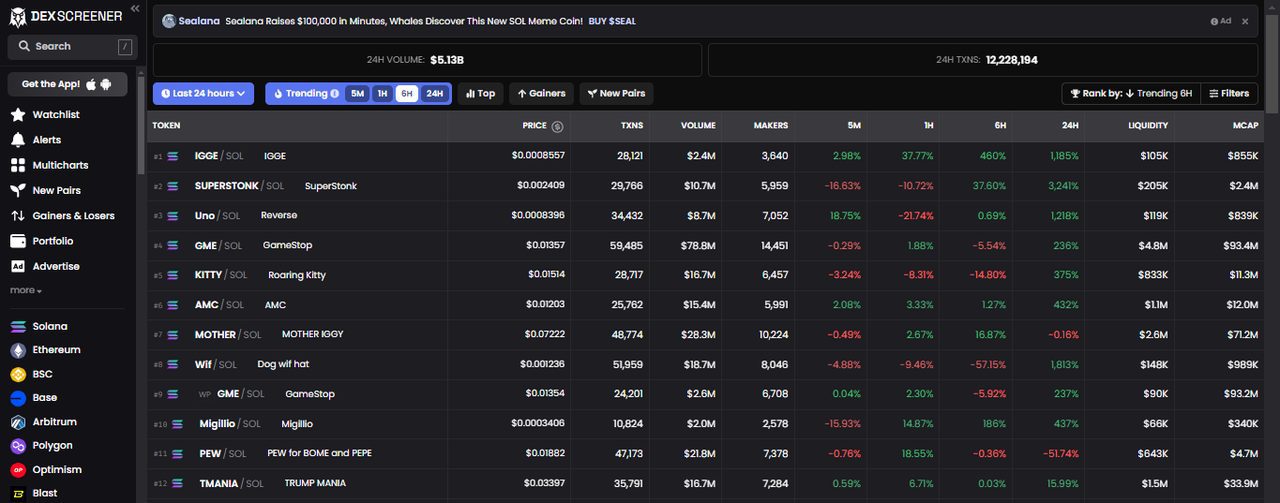

It sounds counterintuitive: platforms like DexScreener generate up to $200 million annually by listing scam or meme tokens, yet simultaneously serve over 1.5 million active monthly users who rely on their analytics for real trades. This “freemium paradox” — free core services combined with lucrative paid promotions — reveals a delicate behavioral dance between supply and demand. The crypto attention economy thrives on FOMO, social proof, and the contagious spread of hype, often anchored by scam tokens. DexScreener’s proprietary trending algorithms and whale tracking tools do not just report market data; they amplify social signals that traders subconsciously follow. What appears as dark patterns may, in fact, be an emergent nudge ecosystem, where cognitive biases like anchoring and loss aversion are weaponized by market participants themselves.

Yet, this is not merely a tale of exploitation. The platform’s automated blockchain indexer — parsing raw logs from 80+ networks in real-time — enforces a form of transparency unseen in traditional finance. Unlike centralized exchanges or opaque order books, DexScreener exposes liquidity heatmaps and slippage risks live. In this way, the chaotic presence of scam tokens paradoxically functions as a stress test, training traders in risk budgeting and volatility navigation. DexScreener’s success amid controversy exemplifies how imperfect ecosystems can foster emergent intelligence through unfiltered data.

Down the Rabbit Hole: How Automation and Behavioral Economics Collide

The platform’s lean team of fewer than 10 employees supports a technical moat with a proprietary blockchain indexer and microservices architecture, delivering sub-second data updates without external API dependencies. This operational efficiency is staggering — revenues exceeding $250 million annually with extraordinary revenue-per-employee ratios suggest hyperautomation. Yet, automation here does not mean neutrality. The platform’s paid listing model ($300 per token) and “boosting” services influence which tokens gain visibility, embedding economic incentives deeply into user interfaces and social sentiment flows.

This phenomenon echoes the concept of “nudge design” from behavioral economics, where subtle cues steer decision-making. DexScreener’s interface, coupled with its token promotion packages, creates an ecosystem where perception and reality blur. Traders face a cognitive overload of information, compelled to rely on heuristic shortcuts — trust heuristics, social proof, and urgency effects — that can either protect or mislead. The platform’s whale tracking and custom alerts become double-edged swords, offering both early demand signals and potential triggers for panic-induced overtrading.

For traders seeking to “go here” for reliable DeFi insights, understanding this interplay is crucial. The embedded dexscreener platform exemplifies how technology and psychology coalesce, forming a new class of “behavioral alpha” extraction tools that reward savvy users who can decode the nudge patterns.

From Trust Deficit to Trust Heuristics: The Evolution of On-Chain Analytics

The reputational risk DexScreener endures — including a Trustpilot rating of 1.8 stars and public criticism from industry leaders — underscores the fragile trust dynamics in DeFi. Yet, paradoxically, its user base continues to grow. Why? Because traditional financial platforms fail to capture the multi-chain, real-time complexity that DexScreener delivers. Its direct node connections across 80+ chains and absence of external API reliance create a data fidelity unmatched by competitors.

This creates a new form of trust heuristic, where users understand that absolute trust is impossible but calibrated trust is attainable through transparency and continuous feedback. DexScreener’s ecosystem functions as a real-time behavioral laboratory, where traders learn to discern signal from noise amid rampant misinformation. The platform’s “Moonshot” launchpad and trading bots further integrate behavioral coaching by offering incentive-aligned token launches and customizable alerts that help users manage FOMO and liquidation anxiety.

In this sense, DexScreener redefines trust not as a static attribute but as a dynamic process rooted in data openness and user agency. Its growth trajectory is a testament to how behavioral KPIs may trump traditional compliance metrics in the fast-evolving DeFi landscape.

Beyond the Horizon: How DexScreener Shapes the Future of DeFi Trading

Looking ahead, DexScreener’s expansion into institutional services, paid APIs, and deeper TradingView integration signals a maturation from retail chaos to professional-grade analytics. However, the platform must navigate intensifying regulatory scrutiny amid the proliferation of scam tokens and “dark pattern” accusations. The key challenge lies in balancing monetization with reputation — a tension that reflects the broader DeFi paradox of permissionless innovation versus market integrity.

Drawing from complex adaptive systems theory, DexScreener exemplifies a “reflexivity loop” where user behavior, platform design, and market outcomes co-evolve. Its unique position as both a facilitator of potentially dubious token hype and a crucible for behavioral discipline offers a blueprint for future decentralized analytics — where transparency and incentive design coexist with cognitive biases and market manipulation risks.

For those willing to master this new terrain, DexScreener is not just a tool but a cognitive prosthesis, amplifying human intuition with machine precision. To discover how to harness this paradoxical power, traders can go here and experience firsthand the intersection of raw data and behavioral insight.

Questions That Change Everything

Is DexScreener promoting scam tokens knowingly, or is this an unavoidable byproduct of DeFi openness?

While DexScreener’s paid listing model incentivizes token promotion, its automation and sheer volume make manual moderation impractical. This tension is a systemic feature of permissionless blockchains, where openness breeds both innovation and vulnerability. The platform’s disclaimers and user reporting attempt to mitigate harm, but ultimately, traders must deploy behavioral tools to navigate the ecosystem.

Can traders truly rely on whale tracking and trending algorithms if these are manipulated by paid boosts?

Paid boosts introduce noise, but they also generate early demand signals that savvy traders can interpret contextually. Whale tracking reveals large on-chain movements that are harder to fake. The key is to combine multiple indicators and maintain a critical eye, transforming these tools into a form of “behavioral alpha” rather than absolute truth.

Does DexScreener’s extraordinary revenue-to-employee ratio signal hidden risks or operational miracles?

This ratio reflects extreme automation and lean operations but also hints at potential scalability and compliance vulnerabilities. A small team managing massive revenues from token advertising is unusual, raising questions about governance, transparency, and long-term sustainability. Investors and users alike should watch for signals of operational strain or regulatory pushback.